Overview of Behavioral and Household Finance (2016-17)

Illiashenko, P. (2017)

Behavioral Finance: History and Foundations.

Visnyk of the National Bank of Ukraine, (239), 28-54.

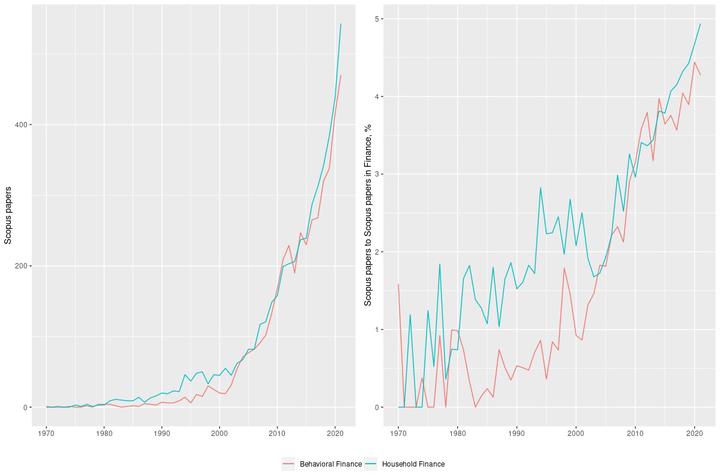

Recent evidence suggests that ideology has the potential to affect research in economics and that exposure to a wide range of approaches may increase intellectual diversity, eventually leading to better decisions. Therefore, writing a literature review in behavioral finance, in principle, can bring benefits to a wide range of readers, especially since the field of behavioral finance itself has already grown into a complex web of related but distinct sub-fields and reached a stage when it can guide policy decisions. This review differs from the existent ones as it focuses on the history of the field and its psychological foundations. While the review of psychological foundations is necessary to appreciate the benefits of a behavioral approach and understand its limitations, even a brief historical detour may provide a compelling case against a naïve dichotomy between behavioral and classical finance.

Illiashenko, P. (2017)

Behavioral Finance: Household Investment and Borrowing Decisions.

Visnyk of the National Bank of Ukraine, (242), 28-48.

Behavioral finance is still mostly perceived as a field solely devoted to the study of asset pricing and the behavior of individual investors. Such interpretation is largely misleading as it overlooks a growing body of empirical work in household finance, a sub-field of behavioral finance concerned with household investment and borrowing decisions. By focusing on household under-saving, non-participation, and under-diversification, as well as mistakes in choosing debt contracts and managing debt obligations, this paper aims to present recent findings from the field of household finance to a wide audience. This review differs from existing ones by focusing on the plurality of non-mutually-exclusive explanations of observed phenomena, including explanations from both behavioral and neoclassical traditions. In addition, this paper focuses on the choice between fixed-rate and adjustable-rate mortgages given their significance for macrofinancial stability and discusses evidence of firms being aware of the behavioral weaknesses of households and exploiting them readily.